The Quant Engine for Venture Capital

We turn founder execution into real-time portfolio foresight — helping funds protect IRR, reduce write-offs, and surface outliers earlier.

Predict the trajectory of your portfolio — not just report on it.

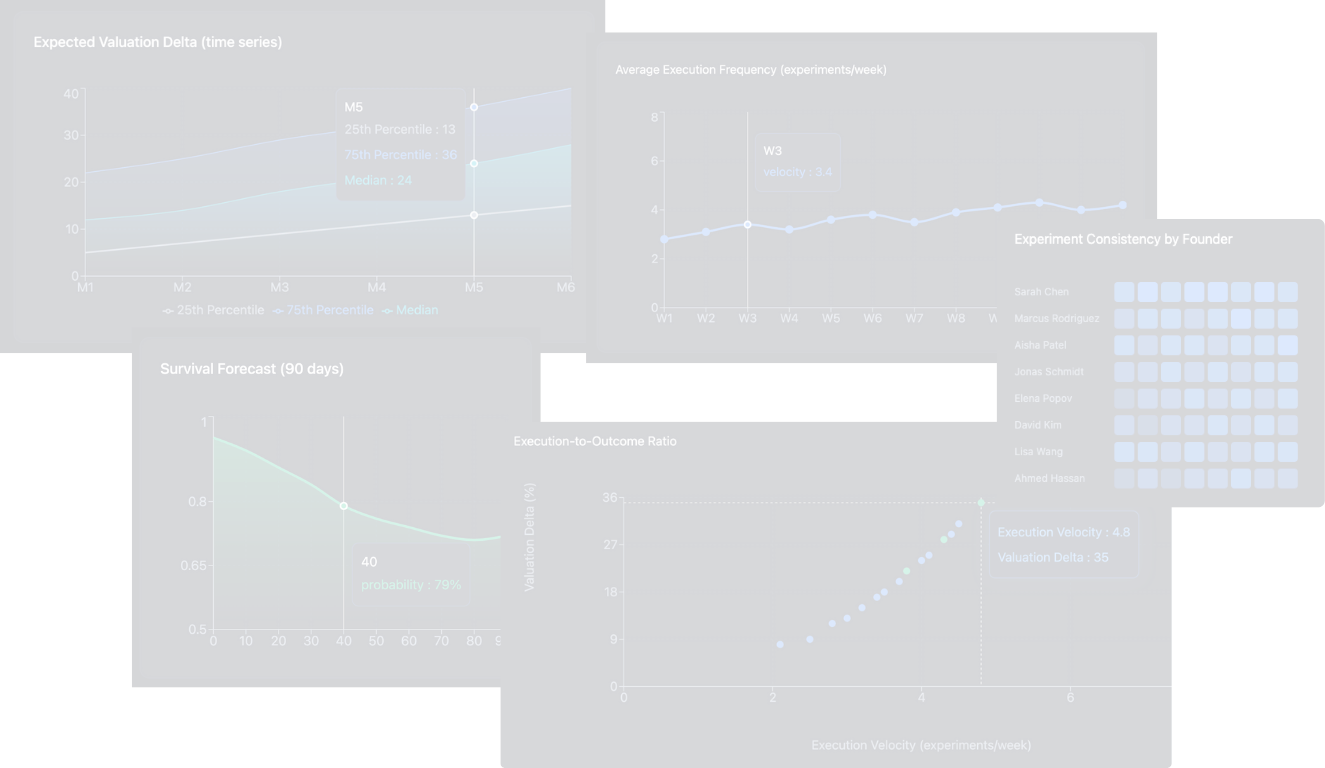

- ● Expected Valuation Delta (Δ)

- ● Execution Velocity™

- ● 90-day Survival Probability

- ● Execution-to-Outcome Ratio™

- ● Portfolio Correlation

- ● And more

Give your platform team a predictive view of the portofolio in real time — turn portfolio work into the fund's internal intelligence layer.

The Quant Edge: Probabilistic Foresight for Capital Allocation

Bayesian inference, Real Options pricing, and Monte Carlo–driven models calculate portfolio outcomes and risk trajectories in real time — providing predictive visibility across vintages and stages.

Expected Valuation Delta

The modeled change in a startup's expected valuation in future rounds based on its latest execution data.

Identify whether founder actions are creating or eroding enterprise value before the market.

Survival Forecast (90 days)

90-day operational survival forecast combining execution activity, traction signals, and consistency metrics to predict portfolio resilience.

Early-warning radar for portfolio risk: Forward-looking risk signal, enabling proactive support and sharper follow-on decisions.

Insight Layers

Execution (EV)

The speed and consistency of founder activity — experiments, iterations, and learning cycles per week.

EV is the strongest behavioral predictor of survival and early traction.

Traction Efficiency™ (TE)

How efficient in generating market signals is the founder's go-to-market activities.

Validated signals increase with execution volume

Low EOR = wasted motion

Execution-to-Outcome Ratio™ (EOR)

Sharpe Ratio for founders: indicates performance per unit of effort. Filters noise from activity.

How effectively execution converts into measurable progress.

Teams with shorter pivot cycles outperform slower peers by 1.8x in Expected Valuation Delta.

Founders in the top quartile of Execution Velocity show 2.6x higher Expected Valuation Delta over the last 6 weeks.

Founders validating more than two channels within 30 days achieve 3x higher acquisition efficiency.

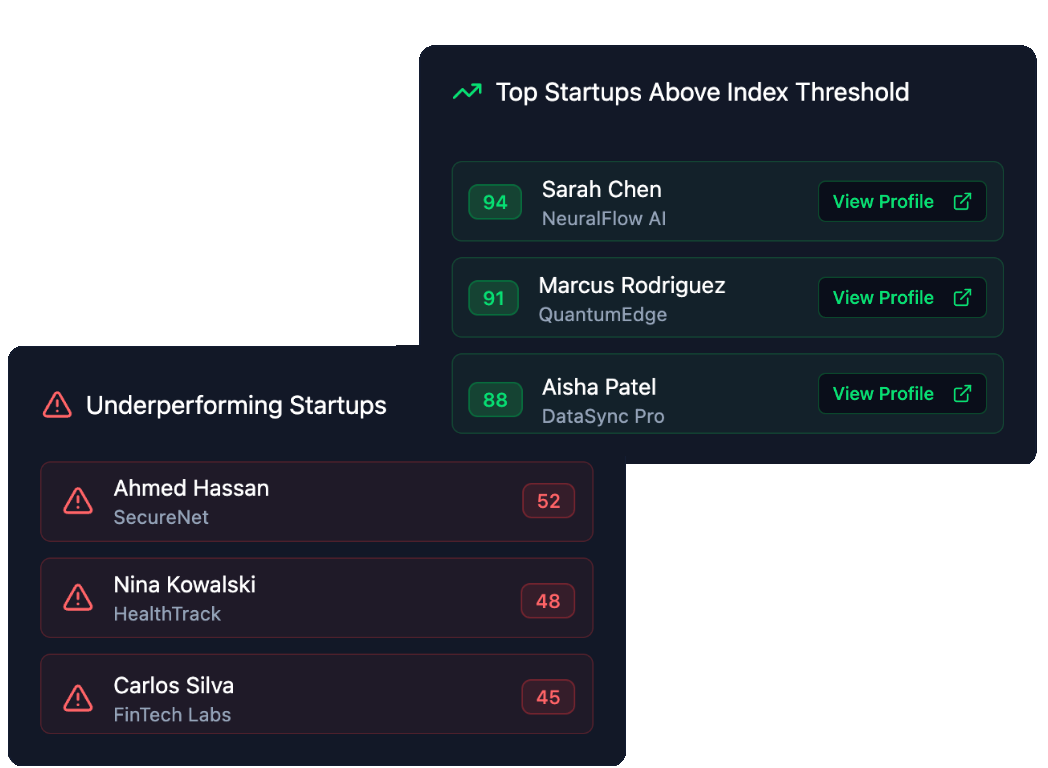

Starman Risk Index™

A single metric of founder strength and fund-wide performance

A composite risk-adjusted score combining all inference outputs — execution, learning, traction, and valuation signals.

Enables objective ranking across founders and portfolios — the quant layer for venture allocation.

The 100× Value: Quant Intelligence That Scales Across Your Team

From partner strategy to associate diligence, Starman amplifies decision quality across every layer of a venture firm — driving 10x the output at 10% the cost, creating over 100x the value invested.

Fundraising and LP Allocation

Quant-backed credibility accelerates capital inflow

Portfolio Reporting

Greater LP trust with data-driven allocation conviction

Portfolio Monitoring & Updates

Eliminate manual quarterly tracking and repetitive analyst work

Investment Speed Coming Soon

Real-time data cuts diligence, builds conviction, and increases compounding period

Lower Sourcing Cost Coming Soon

Automated sourcing and quantified ranking significantly reduce manual parsing and false positives

Dealflow & Branding Coming Soon

Network effects scale your brand's reach to top founders, generating high-signal dealflow

Write-off Probability

Flag high-risk performance months prior to investor updates.

Early churn detection can save 1 in 5 failing startups, reducing write-offs by 15-25% over a fund lifecycle.

One right signal compounds returns for years to come.

Spot outliers sooner and never miss a winning deal again.

*Based on one £200M exit achieved

"You don't lose sleep over the investments that fail, but over the ones that got away."

Plus...

Publish unique insights, positioning your fund as rigorous and analytical in a space dominated by intuition.

Data-driven funds attract higher-caliber talent who want to work with structured intelligence, not spreadsheets.

Be recognized by LPs as "systematic allocators," not storytellers.

Top founders are drawn to "smart money" funds that understand their data.